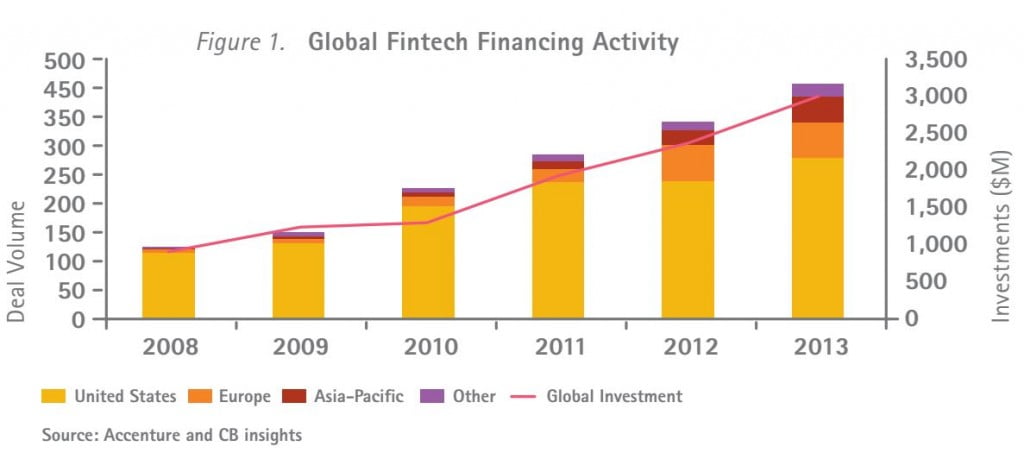

‘FinTech’ is a term you may have encountered in the tech news headlines and wondered what the connection is between finance, a sector heavily-burdened with century-old institutions, and technology, the constantly changing face of human innovation. In layman’s terms ‘FinTech’ involves the ability to carry out any number of financial services from the comfort of your computer or smartphone screen. But what are the forces at work behind the exponential rise of FinTech companies (and their $$$ valuations), and why does a relatively small market like Israel remain one of the main sources for FinTech innovation?

Shifting the balance in bank – customer relationships

Back on the eve of the global financial crisis in 2008, the majority of people still had to actually visit their bank in order to carry out basic financial services (the deposit “drive-in” if you are familiar with the 90’s-era concept). Banks held a firm grip over everyone’s finances and there was barely a tinge of innovation, or thoughts of making financial services easily accessible. But within months of the meltdown and with consumers’ faith in banks at its lowest, some entrepreneurs decided it was time for serious change.

“FinTech is a big word that means a lot of different things,” says Raphael Ouzan, co-founder and CTO at BillGuard, a leading Israeli FinTech startup that has developed technology to protect users against “grey” charges. “If you look at it from an economics standpoint, it’s all about introducing alternatives to services that banks have been providing for decades.”

This is the first thing that the over 500 FinTech companies currently in existence have tried to achieve – taking traditional services like lending, deposits and payments out of the hands of the banks and putting them into the hands of the customer. For Ouzan, it’s all about rebuilding the trust breached by two centuries of financial crises with institutional banks at the helm.

SEE ALSO: Startup ‘TipRanks’ Tells You Who Are The World’s Best Financial Analysts

“There is a massive opportunity to leverage banking data for the sake of transparency. I believe that the services we are able to provide as far as your money goes will eventually take over the banks,” says Ouzan of what he hopes will be the future of FinTech.

In the FinTech age, banks are tasked with innovating

The banks, however, don’t seem to be to be losing sleep over the arrival of FinTech. Nadav Yur, Head of Digital Concepts and Big Data at Israel’s largest bank, Bank HaPoalim, says innovation and tech is now on most banks’ radars. “Traditionally, banks are used to developing infrastructure and applications in-house, but obviously we understand that we need to open ourselves up from business, cost-efficiency and innovation stand-points,” says Yur. However, he makes it clear that while FinTech is a growing sector that must be addressed by banking giants, it hasn’t really had the disruptive affect Ouzan alludes to. “Since FinTech doesn’t affect our quarterly bottom line, it’s not the immediate concern of managers. This presents the challenge of directing enough managerial focus and resources into FinTech, including collaboration with investments and startups.”

For a banking executive tasked with seeking out innovative companies, Yur is in the right spot. Israel is considered a global FinTech powerhouse, with over two hundred FinTech startups and other more well-established firms. From valuable Information Technology protection for large banks (a field Israel shines in), to big data solutions like BillGuard’s, and “crowdsourced” investment solutions like eToro’s social trading network, the Startup Nation has it all. Tel Aviv was even ranked fifth in the world for its adoption of cryptocurrency Bitcoin and was one of the first cities to open a Bitcoin ATM to the general public.

Israel’s comparative benefit in the global FinTech market

To lead in FinTech innovation, Israel has a number of advantages, including its small size, which acts as a great testing ground; very high mobile engagement among Israelis; and the big data skills learned in Israel’s elite army intelligence units, like the 8200 unit, known for its crop of future star entrepreneurs.

Sign up for our free weekly newsletter

Subscribe“I think the great advantage of Israeli FinTech is that there is a limited local market, which forces the local FinTech industry to focus on larger global markets,” says Yoni Assia, CEO and Founder of eToro, the social investment network that uses real-time features to let users follow and trade based on other users’ activities. “The payments, trading and Bitcoin systems that emerged in Israel are in general more global than those in other countries,” adds Assia. The “microcosm” of Israel represents a good trial market for global-geared financial startups that want to make sure that their technology really works before they launch it in the US, an economy 39 times the size of Israel’s.

SEE ALSO: From Startup Nation To Scale-Up Nation, Israel Reached New Heights In 2014

“I really feel that Israel is a point of reference for many financial institutions, and in many aspects we are more advanced than a number of banks in the world,” explains Yur, who claims that the ability of Bank HaPoalim to test out mobile applications and new financial services far surpasses US and European banks.

This leaves room for the bank to invest and give back to FinTech startups through its support programs (as does its competitor, Israel’s Leumi Bank, through LeumiTech) and to engage international banks’ interest, CitiBank and Barclay’s most recently, in financial management technologies developed by Israeli startups.

But for many, the secret weapon Israelis have over other countries is its elite intelligence units like 8200, where the likes of BillGuard’s Ouzan have served. He says, “Much of our work in 8200 has to do with organizing a big, bureaucratic enterprise like the army. In many ways it’s similar to the challenge FinTech presents, so it’s very helpful.”

Besides BillGuard, which processes an enormous amount of data on credit card charges to help users track their spending and identify possible fraud, other notable 8200 graduates who have moved into FinTech include the founders of ThetaRay, a threat-detection solution to protect financial institution’s infrastructure, and Trusteer, another information security company that was acquired by IBM for $900 million in 2013.

From deposit drive-thrus to App Store tellers

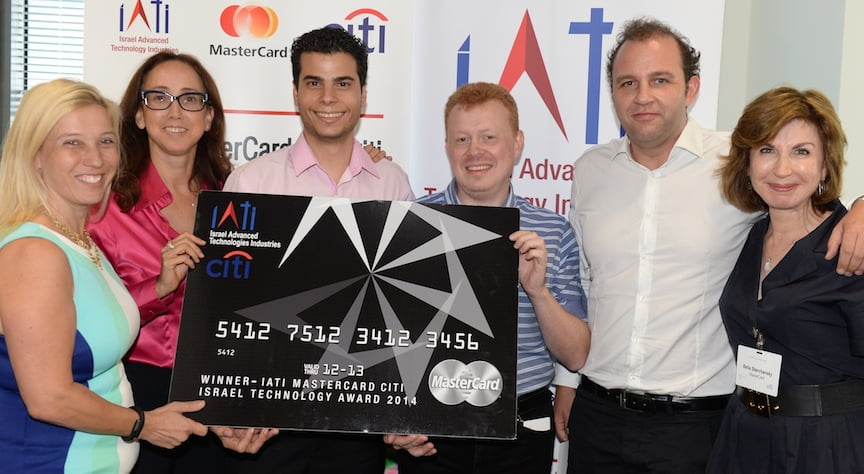

Other shining stars include Actimize, a big data company with real solutions for fraud prevention and risk management, as well as companies like Pricence, an intelligent pricing platform that was selected by MasterCard for the Israel Technology Award, and the breakthrough global mobile payments company Payoneer (now a Member Service Provider of MasterCard worldwide).

eToro‘s Assia believes this is all for the greater good: “Having people share their finance knowledge with one another creates more transparency in the markets and will lead to a better understanding of consumers and new kinds of products that will utilize the wisdom of the crowd.”

Despite FinTech’s tremendous progress in giving people control over their money, Ouzan’s dream of eliminating “physical” banking institutions is still far off. But he’s not giving up. “I await the day when banking will become a platform serving customers rather than a monolithic bureaucratic platform,” he says. “Just imagine the bank becoming the App Store.”

Photos: Accenture/ MasterCard

Related posts

Editors’ & Readers’ Choice: 10 Favorite NoCamels Articles

Forward Facing: What Does The Future Hold For Israeli High-Tech?

Impact Innovation: Israeli Startups That Could Shape Our Future

Facebook comments